Carbon Credits in Nigeria: Meaning, Measurement, and Market Potential

Sometime last year, during a community outreach program I attended in Abuja, a young farmer asked me: “Oga Temitope, this carbon credit we dey hear, e be like oil money or na just another grammar?”

That moment stuck with me. Because the truth is, carbon credits are like the crude oil of the green economy, and Nigeria, with its vast land, forests, and innovation potential, is sitting on an untapped goldmine.

With climate change already affecting everything from food prices to power supply, the question is no longer if we need to engage in carbon markets, but how.

In this article, I’ll walk you through:

- What carbon credits actually mean (without jargon)

- How they’re measured

- How they apply to Nigeria’s environment and economy

- And the market potential for individuals, businesses, government, and even rural communities

Let’s break it down.

What is a Carbon Credit?

A carbon credit is a permit that allows an entity (a company, farm, or government) to emit one metric ton of carbon dioxide (CO₂) or an equivalent amount of another greenhouse gas.

If you reduce emissions by planting trees, using clean energy, or adopting eco-friendly farming, you can earn carbon credits and sell them to others who need to offset their emissions.

🧠 Think of it like this:

Imagine you and your friend are each allowed to use 10 buckets of water daily. If your friend uses 12 and you use only 8, you can sell your unused 2 buckets to them. That’s the basic logic of carbon credits.

Now replace water with carbon emissions, and you’ve got the idea.

Why Carbon Credits Are a Big Deal for Nigeria

Nigeria is Africa’s most populous country and one of its top greenhouse gas emitters. But we also have:

- Vast forests and mangroves

- Millions of farms capable of regenerative agriculture

- A rapidly growing renewable energy sector

This makes Nigeria perfectly positioned to generate and sell carbon credits.

In fact, according to the Nigerian Climate Change Act of 2021, the government aims to hit net-zero emissions by 2060, partly by leveraging carbon markets.

Plus, with the recent push for Compressed Natural Gas (CNG) as an alternative fuel, even transportation emissionscan be reduced and monetized.

How Carbon Credits Are Measured

To earn carbon credits, you need to prove that your actions are reducing emissions. This is where measurement comes in.

There are three basic steps:

1. Baseline Assessment

You first calculate the emissions that would have happened without your project.

Example: A cassava farm in Benue State using bush-burning emits X tons of CO₂ yearly. That’s the baseline.

2. Project Implementation

You then introduce a greener method, like no-till farming, bio-fertilizers, or agroforestry, that reduces emissions.

3. Monitoring & Verification

Independent bodies verify your emission reductions and issue carbon credits accordingly.

Example: If you saved 200 tons of CO₂, you earn 200 carbon credits. These can now be sold to companies or traded in voluntary carbon markets.

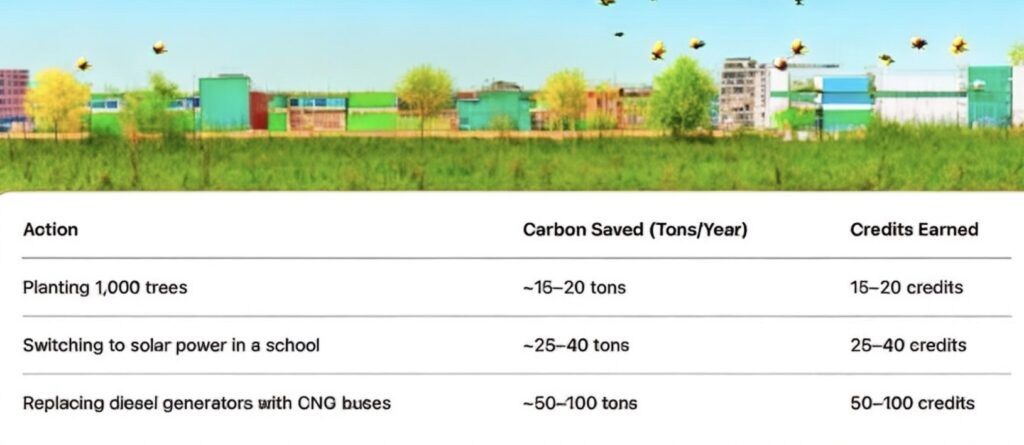

How Carbon Credits Can Be Calculated (Simplified)

Here’s a quick overview:

The Carbon Credit Market Potential in Nigeria

Voluntary vs. Compliance Markets

- Voluntary Market: NGOs, businesses, or individuals who want to offset emissions without legal compulsion.

- Compliance Market: Government-regulated emissions trading systems (still under development in Nigeria).

Today, most carbon trading in Nigeria happens in the voluntary market, where companies abroad are willing to buy credits to meet their ESG (Environmental, Social, and Governance) goals.

Key Market Players in Nigeria’s Carbon Credit Ecosystem

1. Carbon Credit Network (CCN):

A homegrown Nigerian initiative that partners with local farmers and cooperatives to plant trees, promote agroforestry, and generate carbon credits for income. It’s empowering rural communities while tapping into global carbon markets.

2. Nigerian Climate Innovation Center (NCIC):

A local support hub for clean energy startups and carbon-reducing innovations. While not a direct carbon credit broker, it nurtures businesses that can evolve into credit-generating ventures.

3. Carbon Limits Nigeria:

A consultancy working on emissions reductions strategies and project development for carbon markets. They advise companies and governments on how to create bankable carbon credit projects.

4. Climate Finance Accelerator Nigeria (UK Government initiative):

Supports early-stage carbon-related projects in Nigeria through funding, technical assistance, and matchmaking with investors.

5. Sahara Group / Asharami Energy:

Sahara Group has made statements around sustainability and has projects that are pivoting towards climate-aligned practices, potentially entering the credit space through offsetting emissions from oil and gas.

6. Verra:

A globally recognized certifying body behind the Verified Carbon Standard (VCS). Several Nigerian carbon offset projects — like clean cookstoves and afforestation — are registered under Verra, making it a crucial enabler for accessing international buyers.

7. Gold Standard:

Another respected global certifier with stringent sustainability criteria. A few Nigerian energy and agriculture projects are registered here, especially in renewable energy and clean tech.

8. Nairobi-based Komaza:

A Kenyan-based reforestation startup known for smallholder partnerships. While Komaza is exploring West African expansion, including Nigerian woodlots, they are not yet a major player in Nigeria.

What It Means in Naira

Carbon credits typically sell for $5 to $15 per ton in the voluntary market, but premium credits (e.g., from projects with social benefits like women empowerment or job creation) can sell for up to $30.

Real-World Use Case: Agroforestry in Oyo

A farmer cooperative in Oyo State partnered with an NGO to plant 10,000 trees and adopt sustainable land use practices. Over 3 years, they generated over 2,000 carbon credits, which they sold to a European tech firm looking to offset its emissions.

For the farmers, this wasn’t just about climate, it meant new income, better soil, and long-term sustainability.

Challenges and Solutions of Carbon Credits in Nigeria

Challenge: Low awareness:

Solution: Community training and public educationChallenge: Verification costs:

Solution: Government subsidies and partnerships with NGOsChallenge: Market access

Solution: Platforms like CCN, NCIC, and others provide accessChallenge: Policy delays

Solution: The Nigerian Climate Change Council is working on clear regulations

Government’s Market Potential

One of the most strategic moves Nigeria can make is to incentivize big corporations, especially in oil, gas, manufacturing, and power, to participate actively in the carbon credit space.

Companies like Dangote Group, OANDO, NNPC Limited, SEPLAT, Sahara Group, and TOTAL Energies all operate in carbon-intensive industries. These corporations emit thousands, even millions of tons of CO₂ annually, making them prime players in both:

- Offsetting emissions through verified carbon credit purchases

- Generating carbon credits through clean energy investments and sustainability projects

How the Government Can Tap Into This Market

- Carbon Market Policy Framework

The Nigerian government can set clear, investor-friendly rules for carbon credit generation, trading, and taxation, encouraging corporations to invest in emission-reducing technologies and claim credits.

Imagine NNPC offsetting part of its exploration emissions by supporting a tree-planting or mangrove-restoration program in Bayelsa, that creates jobs, improves biodiversity, and earns sellable credits.

2. Public-Private Climate Projects

With guidance and incentives, the government can collaborate with companies to launch massive carbon-offsetting projects, such as:

- Carbon-neutral cement production at Dangote plants

- Solar microgrids funded by Total Energies in underserved communities

- Methane capture and flare reduction by Seplat and Sahara Group

These initiatives would earn high-quality carbon credits and position Nigeria as a leader in climate finance.

3. National Carbon Registry

Establishing a national digital carbon registry, like Kenya and Ghana are building, will allow better tracking, reporting, and monetization of carbon credits, increasing trust for foreign investors.

4. State-Level Incentives

States can also benefit by allocating land for carbon farming, reforestation, or clean cookstove projects, and working with firms like OANDO or Shell Nigeria to co-develop carbon-generating social programs.

- If Nigeria can help just 10 major companies generate or buy 1 million credits annually, at $10 per credit, that’s a $100 million carbon market, every year.

- Beyond revenue, it’s an investment in cleaner air, better jobs, and resilient infrastructure.

The private sector is already moving. The question is: Will our government lead the charge, or play catch-up?

My Final Take

As someone passionate about climate justice, I believe Nigeria should not only be a victim of climate change, we must become active participants in the green economy.

Carbon credits offer us a powerful tool:

- To create jobs

- Improve rural livelihoods

- Protect our environment

- And attract foreign investment

But it starts with awareness. With knowledge. With action. And most importantly, with us.

So whether you’re a farmer in Nasarawa, a startup founder in Lagos, or a policy maker in Abuja, the carbon credit conversation belongs to you.

Let’s Keep the Conversation Going

If you have questions about how to measure or register a carbon project, drop them in the comments. Or connect with me , I’m working with a few local NGOs and experts to make this process more accessible for everyone.

Together, let’s turn carbon into capital and build a greener, more prosperous Nigeria. 🇳🇬🌳